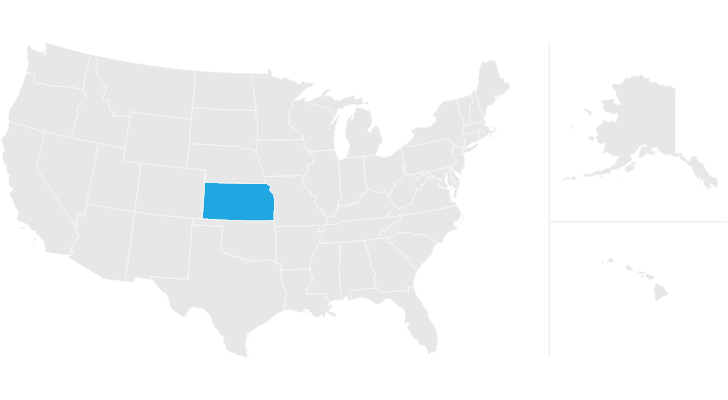

does kansas have an estate or inheritance tax

No estate tax or inheritance tax. State estate taxes were abolished by legislative action on January 1 2010 in Kansas and Oklahoma.

Hi Does Kansas have an inheritance taxwould it apply to someone living in Arizona.

. This was the first execution in the state of Texas since 1964. Fourteen states and the District of Columbia impose an. Real Simples recent article entitled Heres.

If you live in Kansas and you inherit from a decedent in a different state you may be responsible for paying inheritance tax on it. In addition to the federal estate tax of 40 percent some states impose an additional estate or inheritance tax. The state sales tax rate is 65.

The top estate tax rate is 16 percent exemption threshold. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. Kansas does not collect an estate tax or an inheritance tax.

The inheritance tax applies to money or assets after they are already passed on to a persons heirs. Kansas residents who inherit assets from Kansas estates do not pay an inheritance tax on those inheritances. Therefore the estate will have a death tax liability of 40 x 620000 248000.

Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. No estate tax or. This increases to 3 million in 2020 Mississippi.

Since neither type of tax is charged in Kansas you normally will not have to worry about the rules for either. If person living in Arizona had taxes prepared in Kansas because of income received from Kansas. We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax.

Does Texas have an inheritance tax. Beneficiaries are responsible for paying the inheritance tax on what they inherit. The Ohio estate tax was repealed as of January 1 2013 under Ohio.

Many cities and counties impose their. The estate tax is not to be confused with the inheritance tax which is a different tax. However there are other states that charge inheritance taxes estate.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Kansas Inheritance Laws What You Should Know

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Kansas Inheritance Laws What You Should Know

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Estate Tax And Inheritance Tax In Kansas Estate Planning

Estate Tax And Inheritance Tax In Kansas Estate Planning

Kansas And Missouri Estate Planning Inheritance Tax

Estate And Inheritance Tax State By State Housing Gurus

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Don T Die In Nebraska How The County Inheritance Tax Works

Does Kansas Charge An Inheritance Tax

Kansas Estate Tax Everything You Need To Know Smartasset

State Death Tax Is A Killer The Heritage Foundation